Цена Axie Infinity Курс Axs Сегодня, График Axs , Конвертер Usd, Рыночная Капитализация

October 9, 2023

Likewise, it can save us a bit of time and effort by including both cash shortage and cash overage into only one account. To illustrate, we will close the $100 original petty cash fund by returning the cash to the checking account with a debit to cash and a credit to petty cash. After the check is cashed, the petty cash custodian normally places the money in a small box that can be locked. We will not use the petty cash in a journal entry again unless we are changing this original amount. A firm should note instances of cash variances in a single, easily accessible account. This cash-over-short account should be classified as an income-statement account, not an expense account because the recorded errors can increase or decrease a company’s profits on its income statement.

Recording Miscellaneous Expenses Paid Through Petty Cash

The cash over and short account is an expense account, and so is usually aggregated into the “other expenses” line item in the income statement. A larger balance in the account is more likely to trigger an investigation, while it may not be cost-effective to investigate a small balance. A sample petty cash journal entry cash over and short presentation of the Other Expenses line item in an income statement appears in the following exhibit.

- Assume that the company has a petty cash fund of $100 and its general ledger account Petty Cash reports an imprest balance of $100.

- Conversely, a “cash short” situation is recognized as a miscellaneous expense, which decreases income.

- To determine which accounts to debit, an employee summarizes the petty cash vouchers according to the reasons for expenditure.

- This is important for accurate financial reporting and compliance with…

- Opposite to the cash shortage, cash overage occurs when the cash we have on hand at the end of the day is more than the cash sales.

Accounting for Cash Over and Short

Additionally, it emphasizes the significance of reconciling and replenishing petty cash as part of good financial management. In this journal entry, we credit the sales revenue because in the retail business the cash shortage usually happens due to us failing to keep the accurate records that are related to sales revenue. Also, the debit of cash over and short represents the loss, e.g. a few dollars, due to the cash being less than the amount it is supposed to be when comparing the sales records. For example, the cash shortage needs the adjustment on the debit side while the Certified Public Accountant cash overage needs the adjustment on the credit side.

Increasing or Closing the Fund

E objective of this white paper is to identify the unique attributes of cash and understand how they contribute to the demand for cash. Despite this https://www.ekunjika.com/2022/04/01/fob-shipping-point-vs-fob-destination-key/ disruptive evolution, the demand for banknotes and coins has continued to grow at a signi cant pace around the world. Tracking Cash Over and Short is an important piece of protecting a company’s most valuable asset, Cash, from theft and misuse. It may seem like a small item to track, but think of it from the point of view of a retail or restaurant chain where millions of dollars pass through the cash registers every day. Every time a register is short, the company’s expenses increase and profits decrease. A series of cash overs and shorts may be a sign of theft or other problems in the company.

- A $1 overage means a $1 debit to Cash and a $1 credit to Cash Over and Short.

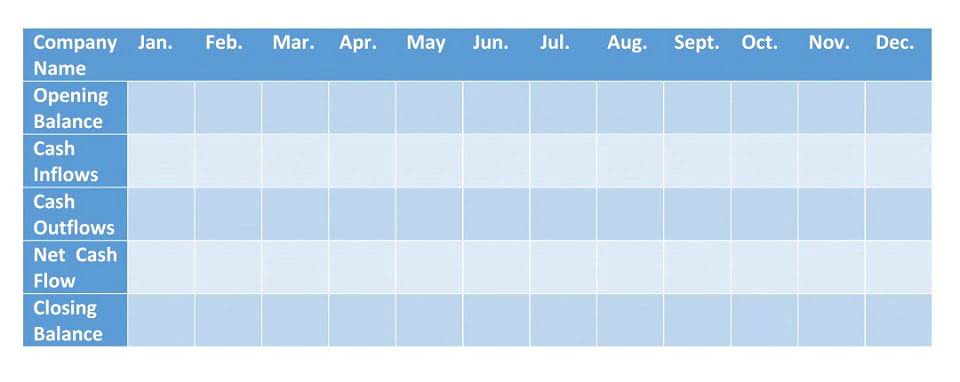

- In other words, a cash flow statement lists down various items and their respective magnitude which bring about changes in the cash balance between two balance sheet dates.

- At the end of the month, assume the $100 petty cash fund has a balance of $6.25 in actual cash (a five-dollar bill, a one-dollar bill, and a quarter).

- In accounting, cash over and short journal entry is usually made when the company replenishes its petty cash fund.

- To illustrate, for a cash shortage, the journal entry debits the “Cash Over and Short” account and credits the “Cash” account to reflect the actual cash count.

- This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

(Sometimes we refer to this fund as an imprest fund since it is replenished when it becomes low.). To determine which accounts to debit, an employee summarizes the petty cash vouchers according to the reasons for expenditure. The journal entry to record replenishing the fund would debit the various accounts indicated by the summary and credit Cash. Let’s illustrate the Cash Short and Over account with the petty cash fund. Assume that the company has cash short and over is classified as a a petty cash fund of $100 and its general ledger account Petty Cash reports an imprest balance of $100.